Posted December 13, 2023

By Ray Blanco

Overcoming China’s Solar Dominance

America is doing its best to pave the way for an alternative-energy revolution.

However, there’s one big problem…

Wherever we look, the trail we’re trying to blaze seems to already be paved.

In a previous issue we took a look at China's dominance in lithium refinement, a critical part of the production of batteries used for eco-friendly electric vehicles, and how it has burdened US manufacturers with inflated costs.

Thankfully, America is moving quickly to set up lithium mining and facilities stateside to loosen China’s grip on this critical market.

However, most of these facilities, along with the battery plants they will be supplying, are only in the beginning phases of setting up operations. It will be some time before we can even hope to see the US begin to strip China of its dominance.

This is unfortunately a common theme when it comes to the sustainable energy sources that the Biden administration is aggressively promoting.

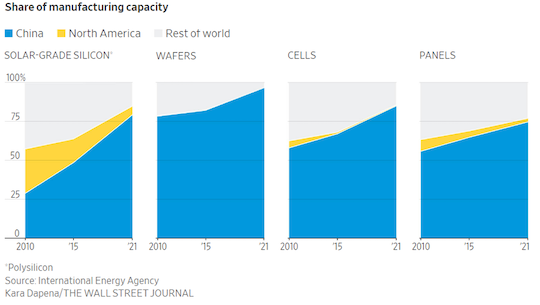

China is showing an even more dramatic dominance in the production of the parts required for solar energy.

If America plans to hit its lofty goals of solar self-reliance, it’s unfortunately headed in the wrong direction…

Currently, solar only accounts for 4% of the United States power generation.

According to the Biden administration, that number will need to increase to 37% by 2035.

That’s a long way to go.

Currently, there’s next to no domestic manufacturing for the parts needed for solar panel construction. The elements that America does produce, like silicon, are being put to other uses, like semiconductors.

To make things worse, a divided US Congress can’t decide on whether to prioritize the slim domestic solar production we have by imposing tariffs on Chinese parts, or allowing manufacturers that require these parts to buy them from the only place they’re readily available.

Our worsening relationship with China and a quagmire of a supply chain has given us no good option for the foreseeable future.

A Ray of Hope

For now, we have no choice but to pick our poison when it comes to solar energy.

Whether we like it or not, China controls the market.

However, it appears that Biden’s clean-energy incentives under the Inflation Reduction Act (IRA) are having their desired effects.

In theory…

Investment in solar in the States is ramping up.

In fact, America’s biggest solar-panel maker, First Solar (NASDAQ: FSLR), is planning to increase its manufacturing capacity by 75%, which would cost roughly $1.2 billion.

This new investment would increase First Solar’s panel-making capacity from an expected 6 gigawatts this year, to 10.6 gigawatts in 2025. Which would be enough to power more than 1.8 million homes.

This aggressive new spending is credited directly to new government incentives introduced with the Inflation Reduction Act, per Chief Executive Mark Widmer.

Additionally, the new incentives are attracting investments from abroad. Hanwha Solutions of South Korea reportedly plans to invest billions into an alternative solar supply chain within the US.

This is all well and good…

But…

As of the 2021, China has already invested over $40 billion into the production of solar panels.

Also, as with America’s commitment to lithium, these seeds won’t begin to bear fruit anytime this year, or possibly even in 2024.

We have not even begun to play catch-up.

So what do you do when every “new road” is already a fully established Main Street?

Maybe it’s time to revisit some older ones.

As I detailed in a recent issue of Technology Profits Confidential, there’s a clean-energy revolution that might not have the shine of newer options like wind or solar, but could be even more promising.

And China doesn’t have a stranglehold on its market…

Nuclear.

With carbon-dioxide taking the place of Public Enemy #1, the safety, viability, and sustainability of nuclear energy has come back into focus.

A once divisive, or even controversial source of energy, nuclear power has seen its reputation do a near 180 among experts and environmentalists.

Key environmentalists such as Gaia Hypothesis inventor James Lovelock, Greenpeace co-founder Patrick Moore, and Whole Earth Catalog founder Stewart Brand have helped sway opinions on nuclear energy.

Nuclear power has been endorsed by Nobel Prize winner and former Energy Secretary Dr. Steven Chu, as well as Bill Gates, Jeff Bezos and Richard Branson

The U.K.’s independent Climate Change Committee has also called for an acceleration of nuclear development.

There’s been a sea change.

Additionally, the same rising tide of IRA incentives that is creating gold rushes in the fields of solar panel manufacturing and lithium refinement is also poised to lift nuclear development.

$30 billion has been earmarked specifically towards nuclear.

This doesn’t even include the $6 billion of Biden’s infrastructure bill dedicated to keeping existing nuclear plants running.

The investment is there.

The sentiment has shifted.

The competition isn’t controlled entirely by China.

The way is clear for the next wave of nuclear technology.

Small modular reactors (SMRs) are the best example of the enormous advancements in the field in recent years.

A smaller, cheaper, and most importantly: safer, alternative to larger reactors, SMRs represent the future of nuclear energy.

Additionally, they can be built in factories, reducing the construction time and cost and allowing them to be transported to a variety of locations.

The thing is, a big hurdle for nuclear energy has always been cost...

If an energy source costs more than an alternative, it’s rarely worth a second look from power companies.

But with SMRs powering a nuclear renaissance, a whole new world is opening up for energy solutions.

On top of that, there are also several other advanced nuclear technologies in development, such as advanced nuclear fuels, which promise to make nuclear energy even safer and more efficient.

So, with many of the technologies currently undergoing testing and development, we could see an even bigger push for nuclear energy over the next few years.

We would like to hear your thoughts. How do you feel about us continuing to rely on China for clean energy solutions? Is American self-sufficiency worth higher manufacturing costs? Does the development of nuclear energy concern you? Share your opinions on this, or whatever is on your mind at feedback@technologyprofits.com