Posted April 25, 2023

By Ray Blanco

The Price of Success

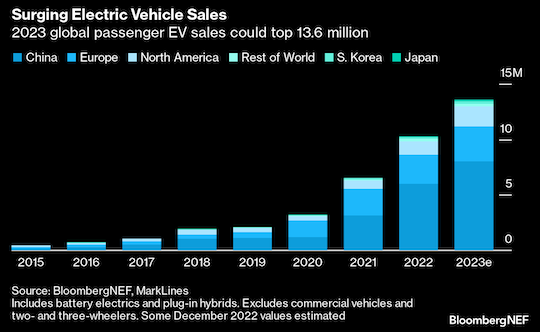

Are EVs the future? It certainly might feel like that to some since general EV adoption is still low relative to combustion engines.

However, as it turns out, battery-powered vehicles are quickly becoming the present.

As you can see, consumer adoption of electric vehicles is growing exponentially.

More manufacturers are jumping on the bandwagon every day and offering EVs at more competitive prices.

Only a few short years ago, EVs were a status symbol.

Shortly after the Roadster was released in 2008, Teslas quickly became the luxury vehicle on the market, getting scooped up by those with enough money (and time, to endure the lengthy waitlists) to acquire one.

Flash forward to 2023…

It’s easy to find a less showy, more affordable model of electric vehicle for consumers who are less interested in showing off than they are in avoiding skyrocketing gas prices.

There are many battery powered passenger vehicles available for under $40k, with the Chevy Bolt and the Nissan Leaf starting under $30k.

The quiet hum of an all-electric engine is no longer a rare sound to hear (or not hear) on the road.

It’s clear, EV’s have sped into the mainstream.

Even still, there’s a hidden cost that electric vehicle manufacturers are paying for a shot at the projected future success of the EV market.

Over the last few years, there’s something else going up just as quickly as the popularity of EVs.

The price of lithium…

Ouch.

It’s tough to make a cheap battery-powered vehicle when their batteries are so pricey.

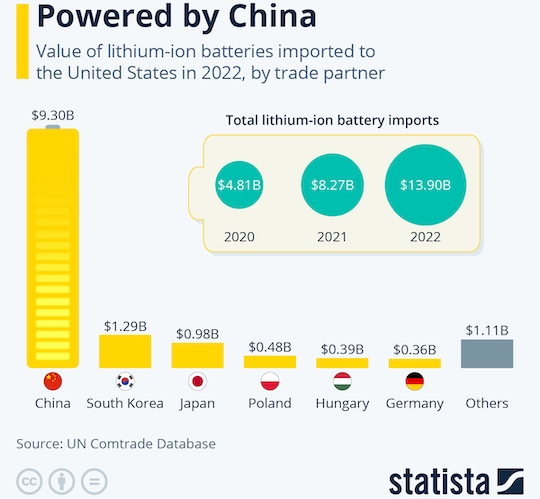

Worse still, China accounted for over two-thirds of U.S. lithium ion battery imports last year.

So far, if we wanted affordable batteries for the EV revolution, we’d have to count on the People’s Republic of China.

Our reliance on China explains why a freefall in lithium prices since November ‘22 hasn’t shown up in the price tag for EV batteries.

It’s clear that unless something changes soon, electric vehicles will become a victim of their own success.

Help On The Way

Good news…

It’s not as bad as it looks.

Auto-makers have noticed the demand for electric vehicles and the U.S. government is pushing hard for cleaner energy.

With enough money on the line and an eager regulatory body, anything is possible.

A focus on domestic lithium mining and refinement will dramatically ease the cost of batteries and boost the profit margins for EV manufacturers.

Tesla, who recently reported disappointing Q1 profits, cited a “choke point” in lithium refining capacity that is inflating production costs.

CEO Elon Musk said…

"The choke point is much more on refining capacity than it is on mining. Lithium is actually very common throughout the world, including in the US. It's much more a question of where is the refining capacity and can the refining capacity keep up."

Musk looked to the future, speaking on the development of Tesla’s new lithium refinery near Corpus Christi, Texas and calling upon other industry executives to focus on being less reliant on China.

He added…

“Like, instead of making a picture sharing app, please refine lithium. Mining and refining, heavy industry, come on”

Certainly, car makers making their own batteries will help their bottom lines.

But the bigger relief in the market price for lithium ion batteries will likely come in the form of Piedmont Lithium’s (NASDAQ: PLL) U.S. based mining and refinement.

The Australian mining company is aiming to increase domestic production by building an integrated mine and refinery in North Carolina.

Another refining plant is in development in McMinn County, Tennessee.

The Tennessee plant alone is expected to produce more than double the lithium hydroxide that America is currently producing.

Will that be enough?

According to Piedmont Lithium’s CEO, Keith Phillips, it’s only the beginning…

"We currently in the US produce around 20,000 tons of lithium hydroxide refined in the US. We think we need over 700,000 by the second half of this decade. So, 35 times more.”

There’s a long way to go, of course.

Piedmont’s Tennessee plant isn’t expected to go online until 2025.

But clearly the call is being answered for the U.S. to take control of its own fate when it comes to producing batteries for the EV’s that are going to soon be the standard for passenger vehicles.

With that, we’d love to hear your thoughts. How do you feel about the selection of available EV’s? Are they worth their price or are you waiting for them to drop even lower? How do you feel about lithium plants being built in the United States? Let us know your thoughts at feedback@technologyprofits.com