Posted March 08, 2023

By Ray Blanco

There’s a Long Road Ahead

Something I’ve covered a fair amount since it first came onto the scene has been the electric vehicle push.

EVs are what many, myself included, believe to be the future of transportation. Whether we’re talking about cars, buses, trains, or even airplanes, if it uses a standard combustion engine, chances are it can be made electric as the technology becomes more advanced.

And the technology has become more advanced, although a little slower than some would have hoped.

Still, the industry remains exciting for automakers and technology fans alike. Many automakers have put up some lofty goals when it comes to EV production and sale.

For example, both Volkswagen and General Motors aim to sell 1 million EVs annually globally by 2025.

Entire countries have even put forth goals of electrifying transportation across the board over the next few years.

Sure enough, carmaker executives and some government officials across the globe are very optimistic about the EV space.

And it makes sense too, replacing all combustion vehicles with electric successors is akin to gigantic dollar signs flashing in front of a salesperson.

There is a massive amount of money to be made for companies that can capture the market in the right ways.

However, the EV market has seen its fair share of blunders in its current state.

Many roadblocks exist that need to be broken down before the EV market can really flourish.

You could consider this period like the calm before the storm. While it’s not exactly rare for someone to own an EV nowadays, it’s exceedingly less common than owning a combustion vehicle.

Even separate from consumers, the need for things like more charging stations, better infrastructure, and more advanced technology all act as barriers to major EV adoption across the world.

And that’s not all, there are quite a few missteps that we keep seeing in the news about companies missing sales targets, experiencing supply chain bottlenecks, and more.

Sure enough, the world has its work cut out for itself if EVs are to be the future of transportation.

Shortages Aplenty

Last year, we saw a major problem work its way not only into the EV market but the automobile market as a whole.

I’m talking about the global semiconductor shortage.

Those tiny pieces of silicon are integral to almost all forms of technology available today. So, when a serious shortage came around, it forced many technology supply chains to pull the emergency brakes.

Lead times and prices for EVs and standard vehicles skyrocketed, even the used car industry saw record prices.

And while that situation has mostly alleviated itself, another shortage looks to take its place.

It has to do with an absolutely essential piece of the EV puzzle: batteries.

Sure enough, auto sector executives are becoming increasingly anxious about surging prices and a tighter supply of metals used in EV batteries.

Certain metals are in high demand within the auto industry, so much so that many big-name car manufactures recently sent groups of executives to the BMO Global Metals and Mining Conference in Florida.

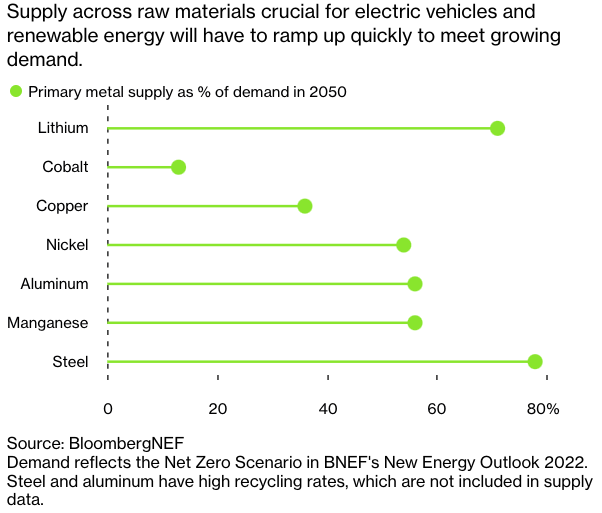

There’s no doubt that the popularity of EVs is growing and will continue growing for the foreseeable future. Alongside an equally popular push toward cleaner energy, it’s estimated that roughly $10 trillion worth of metals used for these applications will be procured through 2050.

From Bloomberg:

Car producers “had room-to-room meetings with a lot of companies, like ourselves, trying to understand how to address their own supply chain,” said Trent Mell, an attendee and chief executive officer of Electra Battery Materials Corp., a Toronto-based developer of mining and refining projects. Auto companies have recently expanded their teams and are now filling rooms with specialists in metals like lithium — the metal that’s ubiquitous in electric car batteries — and manganese, or in battery recycling, he said. “Once you might have had one or two people dealing with raw materials procurement.”

Ultimately, the involvement of auto sector executives in mining conferences implies that they are looking to make alliances and find a path forward to meet the rising demand for EVs.

One way automakers are looking to work around shortages includes getting involved with mining operations.

For example, GM recently invested $650 million in Lithium Americas Corp. to help finish a mine in Nevada.

You also have Tesla personally constructing a new metal refinery in Texas.

So, efforts are being made to push through these shortages. I believe these moves will ultimately benefit the automakers that can make the best strides toward acquiring the necessary materials or obtaining procurement agreements with the miners and refiners that have the most access to these materials.

At this point, with all the investment going on it’s clear to see that The EV boom is coming, the only question is when the levy will break.

Lastly, I’d love to hear back from you on this. Are you excited about the future of biotechnology? Do you think a cure for cancer is possible? Drop me a line and let me know here: feedback@technologyprofits.com