Posted October 24, 2023

By Ray Blanco

The Next Bitcoin Bull Run

What in the world is going on with Bitcoin?

Nothing else can turn heads with a price spike quite like the original cryptocurrency. The last two crypto bull runs had millionaire-making peaks and seemingly came out of absolutely nowhere.

A catastrophic 2022 for cryptocurrency - which included the high-profile collapses of the FTX crypto exchange and Terra’s stablecoin - brought Bitcoin’s price down from its all-time high of over $68,000 to under its 2017 peak of $17,000.

Pair that with blockchains being replaced by artificial intelligence as the Latest Tech Craze and it’s understandable that many people put Bitcoin and cryptocurrency in their rearview mirror.

But considering the velocity of Bitcoin’s last two bull runs, those same people are still watching it out of the corner of their eye, looking for signs of a third.

Which brings us back to our question…

What in the world is going on with Bitcoin?

The famously volatile investment has been unusually steady for the last year and a half.

Following the unexpected collapse of Terra’s stablecoin, LUNA, Bitcoin saw its price fall and eventually flatten out around $20,000.

It has slowly built back its value, spending most of 2023 between $27,000 and $30,000.

But after yesterday’s surge, Bitcoin is at its highest price since May of 2022.

Why the sudden interest?

And where does it go from here?

Saint George And The Dragon

Three letters loom large over Bitcoin and the future of cryptocurrency.

S E C

The U.S. Securities and Exchange Commission has tried to hold the fate of crypto in its hands for years, and chairman Gary Gensler in particular has enjoyed every minute of it.

Gensler has seemingly made it his life’s purpose to dismantle cryptocurrency,

After appearing to be supportive of the technology, Gensler shifted his views dramatically after being appointed by President Biden in 2021.

The SEC brought lawsuits against several crypto exchanges, including Coinbase and Binance, for selling unregistered securities.

Possibly more damaging than the legal action itself is that Gensler and the SEC continue to withhold any clarity on which cryptocurrencies should be considered securities, or why.

This forced holding pattern with the looming threat of a legal hammer falling out of seemingly nowhere has been crypto’s greatest obstacle in recent years.

Bitcoin has also carried the weight of this aggressive uncertainty, despite comments made by Gary Gensler in an interview in which he said “everything but Bitcoin” should be considered a security.

Gensler has looked for attention as the “hero” who will bring down all of crypto and it appears that’s what he’s gotten.

The markets are clearly watching the SEC closely, which brings us back to Bitcoin’s recent price surge.

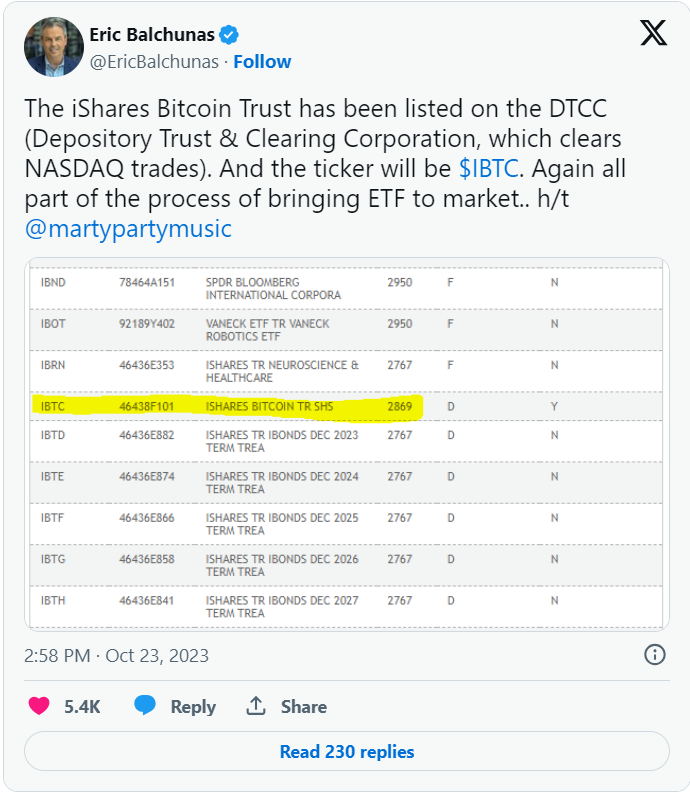

BlackRock, the world’s largest asset management firm, has applied for approval for a Bitcoin ETF, which suggests to many that they already have unofficial approval from the Securities and Exchange Commission.

If the SEC approves BlackRock’s Bitcoin ETF it could be listed on the NASDAQ exchange. It would also likely be the first of many approvals for Bitcoin ETFs, and possibly many other cryptocurrencies.

With the SEC facing a deadline of January 10th to either approve or deny the ETF, investors seem to be getting ahead of the game.

But is it enough to set off a third crypto bull run?

Well, with it still being difficult to tell what the rhyme or reason for the first two…

Why not?

What are your thoughts? Do you think Bitcoin has another bull run in it? Or has crypto already seen its peak? Share your thoughts at feedback@technologyprofits.com.