Posted May 19, 2021

By Jonas Elmerraji

The Future of Bitcoin: $0 or $1 Million

Bitcoin is getting shellacked.

After peaking at $63,410 on April 15, Bitcoin prices have been under immense pressure. This afternoon, they’re hovering somewhere around $38,000 after briefly dipping below $30,000 this morning.

A lot of the blame is being placed on Elon Musk for his about-face on Tesla’s policy of accepting the cryptocurrency as payment for its cars.

Tesla bought around $1.5 billion in Bitcoin earlier this year to support transactions in the currency, only to stop accepting it on concerns over the environmental impact of Bitcoin transactions.

(The computing power needed for a single Bitcoin transaction in 2021 currently consumes 910 kWh, more than the typical American household uses per day…)

But Bitcoin bulls have no fear – per his Twitter feed this afternoon, Elon’s not selling:

Elon referenced “diamond hands” – suggesting that Tesla is holding its Bitcoin here.

A painful as the Bitcoin sell-off has been for Bitcoin owners, context is key. Despite the selling, Bitcoin is still up 26% so far in 2021, more than double the performance of the S&P 500 over that same stretch.

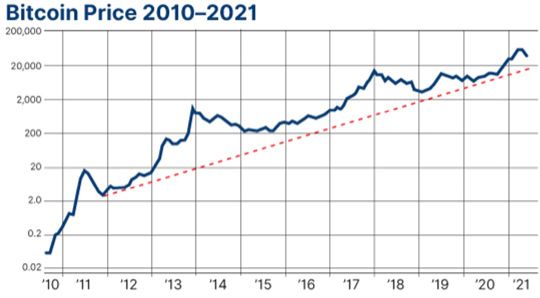

And the long-term uptrend is alive and well:

Volatile as it may seem, Bitcoin’s chop this month is actually pretty much par for the course.

And there are still some compelling arguments for higher prices – much higher prices.

ARK Invest’s Cathie Wood still thinks that Bitcoin is headed for $500,000 per coin. I’ve heard other compelling arguments for Bitcoin hitting $1 million.

The drivers are big and they’re not going anywhere anytime soon. Several years ago, I saw a conference talk given by Fundstrat co-founder Thomas Lee. He pointed to some big demographic shifts as one big driver – like millennials controlling the largest share of disposable income by 2029, and the fact that 30% of millennials prefer Bitcoin to bonds while only 4% actually owned Bitcoin at the time.

Global stores of value – like gold, collectible art and real estate investments – made up around $280 trillion in assets in 2018. Bitcoin and other cryptocurrencies are a tiny fraction of that. If high-net-worth individuals allocate just 1–2% of their net worth to cryptos, it could massively increase demand for Bitcoin, sending prices flying.

Currently, Bitcoin makes up a tiny piece of high-net-worth portfolios, but that’s changing.

Just within the last 60 days or so, Morgan Stanley became the first big U.S. bank to offer wealthy clients access to Bitcoin funds – and it’s letting its advisers put up to 2.5% of clients’ portfolios into them.

Allocating just 1% to a portfolio split between stocks and Treasuries since 20210 increases the risk-adjusted return of that portfolio by 65%.

That’s a hard stat to argue with, particularly as most banks forecast low market returns for the next five years.

Bitcoin may be down, but it’s far from out.

While cryptos may have some more correcting to do in the near term, I’ll be looking for opportunities to “buy the dip.” Stay tuned.

Sincerely,

Jonas Elmerraji, CMT