Posted September 07, 2023

By Ray Blanco

The Chinese Civil War

Earlier this week, I shared with you how China managed to take advantage of several factors - including the demand for electric vehicles and even the war in Ukraine - in order to become the world’s leading automobile exporter.

It was a plan fourteen years in the making, creating an “All-China” EV ecosystem that paid off in a big way when they passed Japan as the number one car producer in the first quarter of this year.

Not only have EV sales within their own country risen dramatically, Chinese electric vehicles are seeing a boom in popularity across Europe. With their market share doubling from 4% to 8% since 2021.

Between the new increase in volume and the nearly cornered market of lithium exports, the EV business has been huge for China in recent months. There has been enough demand and profit to keep all Chinese automakers happy.

These competitors were content to play nice, since it’s easy to keep peace when everyone is fed.

But now that the market has been established, we’re starting to see the gloves come off as Chinese car companies fight for the lion’s share of their market.

Zeekr, the EV division of Chinese automaker Geely, recently lowered the price of all four models of its Zeekr 001 by 10% both at home and in Europe. The move is in an effort to reach its goal of selling 140,000 units in 2023.

The price cut is only a small part of what has become a civil war among Chinese automakers. A chain reaction of price cuts have swept across the entire industry.

Price cuts in this competitive and lucrative market have forced other players to follow suit. Tesla reduced the prices of both their Model Y offerings in China by 14,000 yuan (nearly $2000), Neta lowered prices by up to 49,000 yuan, and SAIC-Volkswagen by up to 55,000.

This series of undercuts is just the latest in what has become a long trend in EV pricing within China…

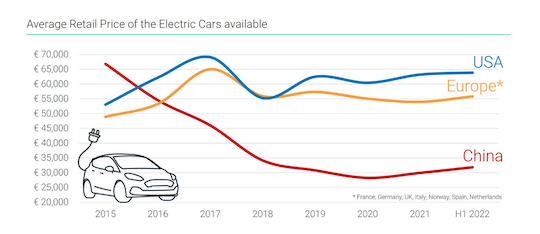

An EV in China has an average cost of under $35,000, as compared to over $60,000 in Europe.

The lower the price, the higher the demand. Right?

It’s gotten China to the top of the automotive hill, but that may not be the whole story.

Collateral Damage

Not everybody in China is thrilled with electric vehicles getting cheaper and cheaper.

In fact, shareholders in these automotive companies are in a panic. With smaller prices comes a smaller margin. Which has already had an effect on stock prices.

Chinese automakers had a brutal August in the stock market, with nearly every brand taking a substantial loss because of concern for lost profits because of price cuts, or fear for the need for future cuts to stay competitive.

Here is some of the damage from last month…

- BYD down 10.31%

- XPeng down 11.27%

- Geely down 14.38%

Even Tesla took a hit, dropping almost 20% by mid-month before bouncing back in the final week.

In addition to the likelihood of reduced profits, there’s another long term concern for EV makers in China.

What happens when the government incentives go away?

Like the United States and much of Europe, there is a lot of money to be made for both those making and buying EVs. But unlike the US and Europe, those incentives extend across vehicles of all price points.

While this may not be a long term winning strategy for China, it certainly has car manufacturers in the West worried as more and more of the EV market share gets bitten off. Carlos Tavares, the CEO of Peugeot-to-Fiat carmaker Stellantis warned last month of an "invasion" of cheap Chinese EVs in Europe.

With that, what are your thoughts? How long can this model work for China? Would you buy a cheaper Chinese EV if it were an option? Let us know about this, or anything at feedback@technologyprofits.com.