Posted June 16, 2021

By Jonas Elmerraji

The Bitcoin Bottom Is In

For the past month or so, we’ve been talking about Bitcoin – in particular, we’ve been looking at the cryptocurrency’s long-term prospects as it underwent a painful correction.

The prognosis was good.

There’s considerable evidence pointing to meaningfully higher long-run prices for Bitcoin.

At this point, Bitcoin’s status as the “established” crypto means that it’s started attracting institutional money and has become an option for money managers to allocate to their high-net-worth clients’ portfolios.

Just within the last few months, Morgan Stanley became the first big U.S. bank to offer wealthy clients access to Bitcoin funds – and it’s letting its advisers put up to 2.5% of clients’ portfolios into them.

And the value proposition for pro portfolio managers is compelling…

Allocating just 1% to a portfolio split between stocks and Treasuries since 2010 increases the risk-adjusted return of that portfolio by 65%. I think we’ll see mainstream advisers start recommending folks put around 1% of their net worth into Bitcoin; even that would send crypto prices soaring.

ARK Invest’s Cathie Wood still thinks that Bitcoin is headed for $500,000 per coin. I’ve heard other compelling arguments for Bitcoin eventually hitting $1 million.

As I said back in May, while cryptos may have had more correcting to do, a “buy the dip” opportunity was on the horizon.

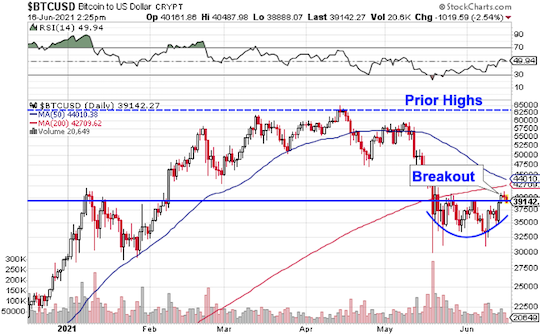

Well, now, it looks like the bottom may be in for Bitcoin. Have a look:

Bitcoin is testing a breakout above the psychologically important $40,000 level this week, pulling off what looks a lot like a reversal. We may see some additional chop as some of the weaker hands try to sell into strength, but the longer Bitcoin holds the line around $40K, the more supply gets absorbed by the market, and the more likely the breakout will wind up sticking.

As my colleague Ray Blanco shared with you yesterday, Bitcoin is getting a major upgrade called Taproot in November, which will bring heightened security to the cryptocurrency. Taproot could also help to alleviate the power consumption problem that we’ve talked about in recent weeks (Bitcoin currently uses vast amounts of power to process transactions).

Taproot also unlocks the potential for smart contracts based on Bitcoin’s blockchain, greatly increasing the utility of the coin.

Just as importantly, the Taproot upgrade is a signal to the broader financial community that Bitcoin can improve incrementally over time, essentially future-proofing itself.

All of these things are good for Bitcoin’s ability to remain the king of the cryptocurrencies.

Meanwhile, for the first time in the last couple of months, the risk/reward tradeoff in Bitcoin looks clearly tilted toward upside again. I’m buying Bitcoin here.

Sincerely,

Jonas Elmerraji, CMT