Posted November 10, 2023

By Ray Blanco

Sex, Lies, And Crypto

It’s official, former founder and CEO of FTX, Sam Bankman-Fried, has been convicted on all charges relating to his multi-billion dollar fraud where customer funds were used for his own investments.

The charges included wire fraud, securities fraud and money laundering.

Bankman-Fried will find out his sentencing on March 28th, which could potentially be over 100 years of prison time.

But that’s just scratching the surface…

The full story involves excess, perversion, and audacity that are almost Shakespearean.

For the full timeline and scandalous details, we turn to Chris Campbell of Altucher Confidential.

Crypto Caligula: the Fall of FTX

[Narrate the following in your head in the style of a Wes Anderson movie.]

Caroline Ellison. Born 1994.

Raised in the suburbs of Boston.

Glen and Sarah, her parents, both worked at MIT.

Yet, young star student Ellison charted her own course - Stanford awaited her.

There, she was an esteemed member of the Effective Altruism Club.

Their slogan? “Maximize Good.”

(This might sound familiar.)

She also underwent not one, but two internships at quant firm Jane Street Capital.

Amidst the numbers and hustle, she crossed paths with a messy-haired kid, known to many as Sam Bankman-Fried, or simply, SBF.

In fact, thinking about it now…

Ellison might be where Sam picked up his “effective altruism” public schtick, which he would later in private admit was a "front” and a “dumb game we woke westerners play, where we say all the right Shibboleths, so everyone likes us."

2017 - SBF left Jane Street and moved to California to start his own crypto trading firm, Alameda Research.

That’s when things got wormy.

Crypto Caligula

2018 - Caroline and SBF meet up again.

SBF told her about Alameda. Ellison was impressed. Especially his grand vision of… you guessed it… effective altruism.

When Ellison joined Alameda in 2018, she admitted ignorance of all things crypto, but was intrigued by the prospect.

As expressed in her blog, she subscribed to the idea that “there are no constitutional rights in substance without freedom to transact.” (True.)

She also wrote: “if authoritarian governments are a serious threat to civilization, which seems not totally insane, it could end up being important.” (Also not false.)

On the back of Alameda’s success (mainly through SBF’s ambitious arbitrage tactics, like the infamous “Kimchi Premium”), SBF founded crypto exchange FTX in 2019.

His timing? Impeccable.

People couldn’t shove money in his face fast enough.

Unfortunately for him…

He spent it even faster than they shoved it.

He spent it on flashy marketing (including that Larry David Superbowl commercial), political donations, jets, parties, luxury hotels, a lavish penthouse, $2,500 lunches, a warehouse-worth of stimulants and sleeping pills, and a fancy HQ in the Bahamas.

And then there was the sex.

You Heard That Right: the Sex

For whatever reason, SBF loved to talk about it.

When he first started his “foray into poly,” he said publicly while (apparently) running FTX, he thought it was a radical shift.

Who asked? Nobody knows.

“But to be honest,” he went on regardless, “I’ve come to decide the only acceptable style of poly is best characterized as something like ‘imperial Chinese harem.’”

(It’s unclear what he meant by that, but let’s just say Caligula would probably approve.)

Perhaps presenting a hint, Caroline noted there was a strict hierarchy within FTX and everyone knew where they fell within it.

Somewhat tangentially, she also wrote a list on her blog around the same time titled: “what I think are some cute boy things”.

They include:

→ “controlling most major world governments”

→ “low risk aversion”

→ “sufficient strength to physically overpower you”

I know what you’re thinking: “THIS IS ALL GREAT, CHRIS, BUT WHERE’S THE PROVOCATIVE STUFF?”

Well, we’re getting there.

The Cold, Hard Facts

At its peak, FTX was valued at $32 billion.

Alameda was behind the scenes, keeping the facade intact.

Ellison was at the center of the vortex.

In 2021, she quickly ascended to co-CEO with Sam Trabucco. Both were featured in Forbes’ 30 under 30.

Trabucco left Alameda in August 2022. He took his millions, bought a boat, and gave the boat a name I won’t dare repeat. The rest is also too provocative to mention. Even here.

Point is, Ellison was on her own. And, to her, it was increasingly looking like she was being set up.

Fast-forward to today:

Ellison framed herself as the patsy. SBF framed her as the culprit.

These are the cold, hard facts about Caroline Ellison.

Most else is a guess:

→ She didn’t do a good job. (No explanation necessary.)

→ She knew she was unqualified. She wrote in her diary: “Running Alameda doesn’t feel like something I’m that comparatively advantaged at or well suited to do.”

→ She was well-paid. In 2021, she was paid a $200,000 salary with a $20 million bonus, $10 million for a startup investment (Anthropic), $2 million for her donor-advised fund, and 0.5% equity in FTX.

→ She’s guilty. She confessed to taking money from FTX to repay Alameda's loans, collaborating with SBF to create misleading financial statements for lenders, and loaning Alameda's funds directly to FTX executives, including SBF.

→ SBF hoped her guilt implied his innocence. But Gary Wong has confirmed that SBF knew and asked Alameda (AKA, Caroline) to use FTX customer funds. (Among other things.)

Stranger things have surfaced in evidence.

Caroline Ellison Wants Blood

For starters, there’s the list Ellison wrote while employed titled, “things Sam is freaking out about.” It includes:

→ “getting regulators to crack down on binance” (yes, really)

→ “raising from MBS” (de facto ruler of Saudi Arabia)

→ “Willie being happy” (the Internet seems to believe this is probably sexual)

Ellison testified that Sam intentionally created the disheveled eccentric nerd image to raise money and get customers. Sidenote: One would be forgiven for suspecting SBF is, in fact, a disheveled slob in real life, too.

She claims to have raised concerns to SBF about the fake balance sheets she was creating. His response? Auditors are dumb and won’t notice.

Ellison also testified that SBF:

→ Bribed Chinese officials with $100 million to unfreeze their assets.

→ Purposely tried to scam Saudi investors.

→ Conspired to keep Bitcoin under $20,000 by selling BTC belonging to customers.

→ Told her he had ambitions to become President of the USA. (He’d fit right in.)

SBF, on the other hand, has worked hard to cover his tracks…

Pinning the blame on Ellison.

The Empire Strikes Back

Some might say this was his fallback plan all along.

In case things went south. In case things got hairy. In case the head of Binance caught wind they were trying to sic regulators on him and then caused a massive run on FTX.

Even before all of that…

When the money dried up, SBF was beginning to throw Ellison under the bus:

"The current Alameda leadership is good,” he wrote, “but not good enough to trust with such a big operation. The fact that we didn't hedge as much as we should have cost us more than all the money Alameda has ever made or will ever make and that's the kind of critical mistake we're likely to make if I'm not actually around running the show there."

He then suggested they use Modulo Capital instead -- run by another ex-girlfriend of his, of course -- of which he was majority owner.

This cut Ellison out.

“Mistakes Were Made”

Brass tacks, as the WSJ pointed out, the entire trial boiled down to this question:

“Is it possible to lose track of $8 billion through an honest mistake?”

Except, of course, it wasn’t an honest mistake.

FTX took customer funds under the guise of custodying those funds for them. The company then built backdoors, allowing them to use and spend that money freely.

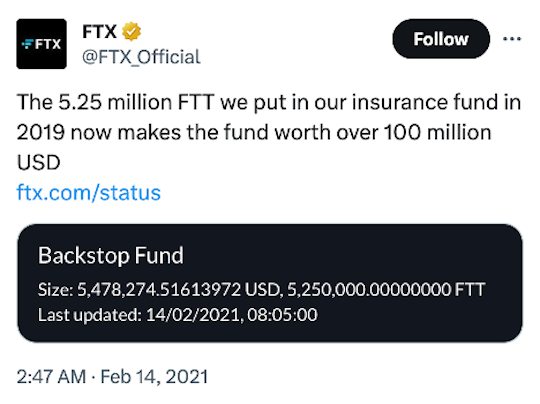

Also, the "insurance fund" FTX bragged about in 2021 was fake. They calculated it by multiplying daily trading volume by a random number.

Everything was fake. Everything.

And now we’re witness to the final chapter.

What Happens Now?

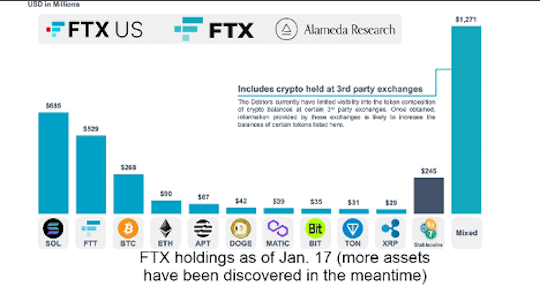

According to several reports, FTX still has $3 billion in crypto that it will eventually dump on the market.

This, some say, is going to cause crypto to rain blood.

Maybe.

But probably not.

One thing to keep in mind is the vast majority of this crypto won’t be sold on exchanges.

Most will likely be sold over-the-counter (OTC).

Also, a big chunk of it is the FTT token. Nobody’s buying that. It doesn’t matter. It’s already basically at zero.

In short…

Bitcoin will be fine. Ethereum will be fine.

Crypto will be fine.

And SBF will be spending a very long time in jail.