Posted August 22, 2023

By Ray Blanco

Nvidia’s Encore

Sequels are hardly ever as good as the original, right?

For every Godfather: Part II or The Empire Strikes Back, there are a dozen Caddyshack 2’s and Jaws: The Revenge’s.

Whether it’s increased expectations or shameless cash grabbing, it’s rare for a follow-up to live up to the hype built by the original.

This is what many are fearing for Nvidia (NASDAQ: NVDA). Last May’s earnings report for the chip maker was a smash hit. Blowing predictions out of the water and launching their stock price to the moon.

Their H100 processor was the most in-demand product for anyone caught up in the AI gold rush. Sales for the superpowered chip paved the way for Nvidia becoming just the seventh company to be valued over $1 trillion.

How can you possibly top that?

Tomorrow, Nvidia will hold its first earnings call since last May when they shocked the world. But this time around, things will certainly be different.

Like any followup installment of a hit movie franchise, people already have their expectations set. And they’re very high this time around.

During their last earnings report, CEO Jensen Huang said that he only expects demand for Nvidia’s advanced hardware to increase as artificial intelligence technology gets adopted into more industries and processes.

It is certainly going to raise expectations when you promise that the best is yet to come following a historic quarter

But success brings its own obstacles. Not only with increased expectations, but also with new logistical challenges. Bernstein analyst Stacy Rasgon explains…

“Supply is very limited, so customers can't get what they want and there's a general behavior that happens in semiconductors and lots of other places, it's called double ordering. When people can't get what they want, they order more."

Rasgon, in her interview on Yahoo Finance Live, went on to say how “double ordering” can hurt Nvidia’s bottom line…

"That's one of the primary controversies is this new level of demand that we see, is that sort of the new baseline for growth? Or is it like pull forward and panic buying and is there an air pocket? At some point, what is the chance that Nvidia will see an air pocket? It's probably 100%. We've seen them before. We'll see it again."

Nvidia has seen a 12% stock boost over the last ten days as the markets anticipate tomorrow’s earnings call.

Riding The Wake

During a race, whether it’s on foot, on a bike, or in a car, being the leader offers one major disadvantage.

Everyone behind you can draft off of you. The wind hits you in your face while everyone enjoys the reduced drag from being behind you.

Nvidia is without question running well ahead of the competition when it comes to producing AI hardware. But that has created a unique opportunity for several other companies in both semiconductors and related fields.

As Stacy Rasgon explained, Nvidia has not been able to even come close to filling all of the demand for its H100 chips. This unsatisfied demand overflows to Nvidia’s competition.

Closest on their heels is Advanced Micro Devices (NASDAQ: AMD), but “close” isn’t exactly accurate, as experts estimate that Nvidia currently controls about 80% of the AI hardware market.

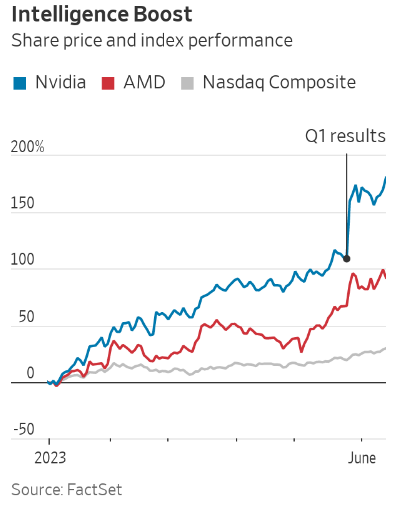

However, looking at the performance of both stocks and the overall effect AI has had on the market proves that there’s plenty to go around:

If it wasn’t for Nvidia increasing its valuation by almost $750 billion over 123 days between last October and mid-June of 2023, Advanced Micro Devices might have been considered the hottest stock on the market. Over that same period of time AMD saw their stock price increase by 112%.

In fact, the PHLX Semiconductor Sector Index (SOX), composed of 30 semi producers, shows that semis are far from being a cornered market:

AMD hopes to take an even larger slice of this ever-growing pie with the upcoming release of a “superchip” that is supposed to outperform Nvidia’s H100.

This chip will combine a central processor, a graphics processor, and memory all in the same chip package. It’s being designed and marketed for use in data centers for companies running advanced AI applications.

With Nvidia and AMD running the show in these early days of AI development, the biggest tech companies are desperately seeking alternatives. Both to manage their own costs and to possibly capitalize on the explosive growth of the semiconductor market.

While giants such as Google, Amazon, and Microsoft are deep into development of their own chips, there are also billions of dollars pouring into semi startups like Mythic and Tachyum.

The search for Nvidia alternatives becomes even more intriguing when you consider the ongoing “Chip War” between the United States and China.

Restrictions were recently placed on the sale of Nvidia’s most advanced AI chips to China out of a concern of them using advanced AI systems to further their military, espionage, and surveillance technology. This has opened the door for competitors to get a larger share of the world’s second biggest economy.

The British semiconductor company Graphcore has been among those to capitalize on the opportunity in China, partnering with the cloud service provider Digital China.

It seems clear, the race for AI hardware supremacy has not already been won. Nvidia’s early lead may seem significant, but in those total technological upheaval that artificial intelligence seems to be causing, their “meager” trillion dollars may end up just being a drop in the bucket.

With that, we’d like to hear your thoughts. Do you think Nvidia can surprise us for a second straight quarter? What will happen if they fall short of expectations? Who is in a position to capitalize on Nvidia dropping the ball? Share your thoughts on this, or anything at feedback@technologyprofits.com.