Posted March 21, 2023

By Ray Blanco

Looking Ahead Into the World’s Next Megatrend

Looking at the markets right now, there’s a lot of uncertainty when you consider all the headline risks contributing to major price swings.

When I say headline risk, I’m talking about the way news events tend to create reactionary moves in the market.

For example, inflation is a big headline risk right now.

It seems like investors are hanging on every word that comes out of Fed officials about whether inflation is cooling or not.

We’ve seen this multiple times over the past few months, almost every Fed rate hike has come with a wild move, up or down, in the market.

This can be tough for investors because although the market makes wild moves on these events, it usually balances itself in the days following.

Inflation aside, the latest market-moving news we got came about courtesy of some big banking blunders.

The whole fiasco with Silicon Valley Bank saw bank stocks fall off a cliff while other areas like tech flourished.

Then this week, some of those poor banks are trying to bounce…

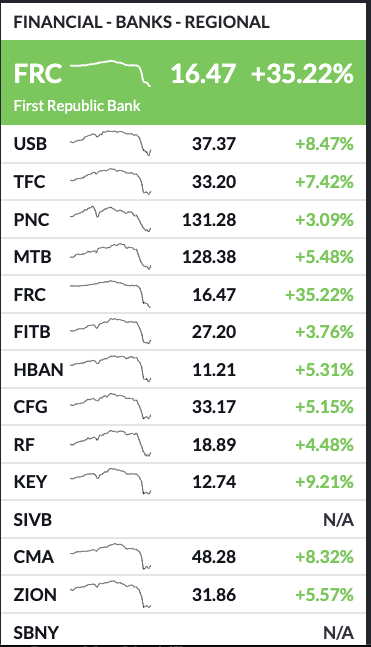

One of the hardest hit banks, First Republic Bank (NYSE: FRC), is up as much as 35% today after we got word from Yellen that the government is ready to step in and provide MORE deposit guarantees if the situation gets worse.

This has sparked a morning rally that’s lifting all boats, just take a look at how bank names are faring today:

So this is what I’m talking about here, news events creating huge swings up or down.

This has resulted in a broad sideways move for the major indices.

Just take a look at the S&P 500, since last spring we’ve roughly traded between 3,700 and 4,300.

During this time, it seems like everyone has been anxiously awaiting confirmation on whether the market wants to rally higher or break down to the next support level.

Even still, I’d say sideways action is better than a complete meltdown…

But with all of this going on, a lot of investors are sitting on cash waiting for confirmation on which way the market wants to move before jumping back in.

That doesn’t mean all you can do is wait right now. In fact, now is a great time to look at long-term plays that look to capitalize on growing innovation trends.

While some of these names might not be getting a ton of love in the market right now, the future prospects shouldn’t be ignored.

In the case of trends like AI, you get the best of both worlds.

AI stocks are quite hot right now and look to continue getting plenty of attention as the megatrend grows stronger and more businesses and individuals incorporate AI into their lives.

Looking Out Toward the Horizon

Just like the internet, AI is becoming a megatrend that will have extremely long-lasting implications.

At the same time, it will generate massive wealth for the investors and businesses that get in on the ground floor.

We’re already starting to see some of that happen now, AI stocks have been some of the hottest names in the market this year.

Even with all of the headline risk going on, AI names have been able to power through uncertainty because the future implications are just too strong.

Looking at use cases in the business world, AI is already becoming more and more common, and its adoption is expected to continue to accelerate in the coming years.

AI can be used to improve efficiency, optimize processes, and reduce costs in a variety of industries, from healthcare to finance to manufacturing.

As the technology advances, AI will likely become an even more integral part of many businesses, helping to drive innovation and growth.

Then, in terms of personal lives, AI is already making its way into many aspects of our daily routines, from smart home devices that can adjust the temperature and lighting to virtual assistants that can help us with tasks like scheduling and shopping.

These types of quality-of-life improvements have already proven massively successful.

We’ve seen the popularity of products like Amazon’s virtual assistant Alexa and Apple’s Siri explode in recent years.

There’s even a multitude of ways that AI can help you generate income.

Have an idea for an app but don’t know how to code it? AI can help get you started by writing the base code for you or, at the very least, providing you with a wealth of educational resources to get you started.

And that’s just one factor, there are so many ways AI can assist in productivity and quality of life that it’s almost impossible to list them all.

Even better yet, there are tons of ways to get invested in the technology right now.

Perhaps most obviously, you have the companies developing the software for AI platforms. One of the most recognizable is OpenAI, responsible for the wildly popular chatbot: ChatGPT.

Of course, OpenAI isn’t publicly traded yet, but one of its biggest investors, Microsoft Corp. (NASDAQ: MSFT), is.

You also have companies like Alphabet Inc. (NASDAQ: GOOG) and Apple Inc. (NASDAQ: AAPL) working on innovative AI platforms.

Then, you can find opportunities with the equipment needed for AI to even work in the first place.

AI platforms require hyper-advanced and expensive hardware to run efficiently, which makes the companies providing that hardware great ways to invest in the space.

Companies that provide the most advanced microchips and processors fit this category.

Finally, we’re starting to see AI-focused ETFs pop up as well. ETFs are a great way to invest in a trend when you aren’t sure where to start.

Needless to say, the opportunities are truly endless right now.

And before I go, I’d love to hear back from you about today’s topic. Are you interested in investing in AI companies? If so, do you have any favorites? Are there any companies you want me to dive deeper on? Drop me a line and let me know here: feedback@technologyprofits.com.