Posted May 13, 2022

By Ray Blanco

How Far can Tech Tumble?

Today, we were treated to a nice relief rally across the three major market indices. The tech-heavy NASDAQ even climbed as high as 4% at one point. However, we’re still a ways away from the previous all-time highs.

One thing’s for sure, investor confidence is shaken right now, and that’s being generous… So, how far will things fall before we see a reversal? That’s a big question on a lot of people's minds as stocks experience big swings up and down.

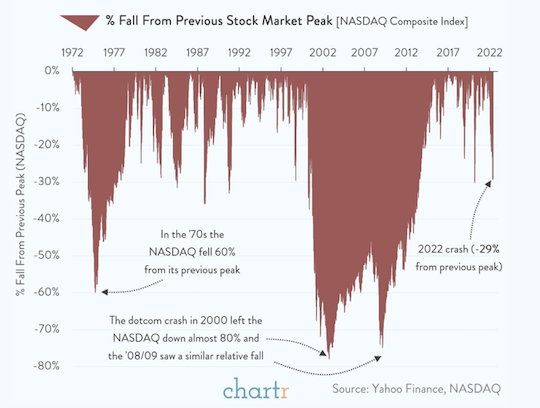

And while that’s a question that nobody has an answer to, we can look to the past for a little clarity. I think this chart does a good job showing where we’re at:

I think it’s important to remember that past market moves don’t necessarily predict future moves, but it does help to see how the market has behaved in the past.

Investors today are dealing with stock market woes as inflation continues to flirt with its four-decade high.

A common theme I’m seeing across financial media outlets is that traders believe a recession is becoming increasingly likely as the Fed Reserve tries to get pricing pressures under control.

The most recent inflation report we got this week, unfortunately, didn’t do much to console investors…

Data showed that price pressures were largely broad-based, prices rose for groceries as well as dining out, airline travel, and other services. Naturally, this did a good job spooking investors who had hoped that we’d hit peak inflation for the time being.

Investors are a reactionary bunch, volatility is certainly ratcheted up the way things are right now. However, especially at today’s prices, many tech names will produce huge gains as they grow and create the future economy. This especially applies to companies advancing in electrifying the economy, from auto manufacturers to battery companies, and from vehicle charging firms to even general aviation.

To a bright future,

Ray Blanco

Chief Technology Expert, Technology Profits Daily

AskRay@StPaulResearch.com