Posted August 16, 2022

By Ray Blanco

Historic Biotech Bounce Back

Biotech stocks are finally coming out of a historic slump and that makes right now one of the best times ever to buy quality biotech names.

Biotechnology companies peaked well ahead of the general market when they set all-time highs in February 2021, fed by a buzz of excitement led by COVID-19-related names. But biotechs also led the decline eight months ahead of the major indexes, losing more than 64% of their value by May of this year.

I’ve tracked the ups and downs in biotech going back 30 years, and the current biotech bear is the worst I’ve ever seen over the period. But if history is any guide, buying biotech now should produce big gains in the months ahead.

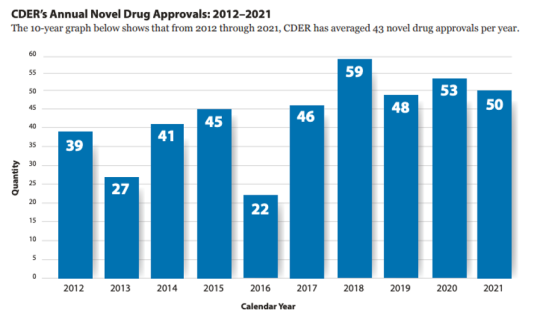

Despite the share price declines, biotechnology companies have performed over this period. Last year, the FDA granted 50 approvals for novel drugs, a near record that includes many first-in-class therapies. So far this year, the regulator has approved 16 more.

Going back to the ’90s, buying the biotech bottom after a decline of 20% or more has led to big gains over the following months, producing a median sector gain of over 50% over the following six months, and an average gain of over 90% over the following 9½ months.

And there’s great reason to believe we’ve already seen the bottom in biotech, and particularly in smaller development-stage companies. In May, the small cap-rich S&P Biotechnology Select Industry Index (SPSIBI) bounced off a level that served as support for the sector during both the COVID-19 sell-off in early 2020 as well as the end-of-year biotech swoon that took place in 2018. In both cases, biotech came back with a roar.

This year we saw that same level tested twice, with biotechs bouncing back from this price level in May, and then again after a general market sell-off in June. Biotech stocks have been roaring for the past two weeks.

It’s increasingly looking like the bottom is in, meaning now is a great time to jump back into some of these innovative companies.

There’s another interesting situation in biotech right now too…

Big biotech and pharmaceutical companies are flush with cash and looking to buy. What better time is there to acquire a unique and innovative small-cap biotech company than when they’re heavily discounted? Well, it looks like some of the big players are gearing up to do just that. I expect to see some important acquisitions get worked out over the next few months.