Posted May 24, 2023

By Ray Blanco

Green Smoke: Carbon Credits

Going green is good business.

However you feel about the methods, there’s no argument that the push to “go green” is driving business in a big way.

But the only “green” most of these companies care about is the dollars they’re collecting from government subsidies and public goodwill.

Today, we’ll continue to highlight how some of these eco-friendly programs and incentives are being exploited in unproductive, or even counterproductive ways.

Carbon Offset Credits

“Carbon neutral”

A goal that’s often touted but rarely explained.

How does a company, or a country, become carbon neutral?

Cleaning up its manufacturing and shipping processes?

That would be something we could all get behind, I’m sure.

No, it’s not that simple. Or actually, it may be even more simple…

But we’ll get to that.

Basically, companies failing to meet emission standards set by, for example, the California Air Resources Board (CARB) can be offset by investing in programs that reduce carbon emissions or clean existing emissions.

Among these programs include reforestation efforts and renewable energy installation.

A simple and effective incentive system, right?

Of course not.

While it may sound like a good idea, the system falls apart due to the fact that a company producing goods can earn carbon offset credits by exceeding emissions standards for their industry.

Why is that so bad?

First, the standards set to earn these credits are a far cry from actively reducing carbon. Rather, they represent a relative standard to the rest of the industry. So companies can earn credits because, well, they could be doing much worse.

Credits are being handed out to companies who are only polluting the planet a little bit.

Worse still, the standards scale to the level of production, so if a company is producing millions of cars that only pollute a little bit each, then they will earn more and more credits for polluting a whole lot.

Of course, there’s the concern of what standards need to be met in order to earn carbon credits, and who is issuing them.

Right now, the definition of “green practices” is, at best, up for debate.

Construction, transportation, mining required metals, infrastructure, opportunity costs. When they’re all factored together, many alternative energy sources are arguably worse than what they’re replacing.

At full scale, in ten years (or twenty) many of these methods would be cleaner, in theory.

But credits are being handed out right now for exceeding these dubious standards.

Questionable standards are made even worse when they’re not even verified. Which, you guessed it, is what often happens with carbon credits.

What takes this system from bad to disastrous is what happens when a company that “could be polluting worse” starts selling its credits to a company that is making no effort to reduce its carbon footprint at all.

Which brings us to…

The Tesla of it All

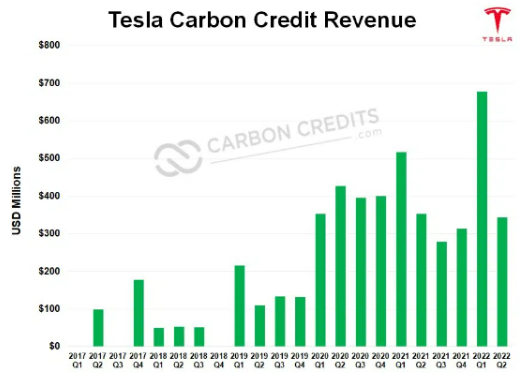

Nobody has made a bigger business out of carbon offset credits than Tesla Inc (NASDAQ: TSLA).

The world’s leading electric vehicle producer made a staggering $1.78 billion selling the credits it earned in 2022 to other automakers, making up a significant portion of their total revenue.

Many argue that this is “free money” for the auto company as there was no additional action taken, beyond simply making extremely in-demand EVs, that actually offset carbon emissions.

So is it just extra money for already making a lot of money from selling a popular product?

It’s actually much worse…

When you consider that it’s competing automakers that make up the consumer base for these credits, each one being sold represents carbon reducing measures that aren’t being performed by those companies.

While many of the details about who is purchasing these credits has remained secret, Chrysler alone has paid Tesla $2.4 billion in order to meet emission standards.

Since 2019, when Tesla began making significant profits from credit sales, few automakers have made meaningful reductions to their emission levels. Which, technically, neither has Tesla…

When you also factor in concerns over the additional emissions used to create batteries (three times higher than production of a standard gas vehicle) as well charging those batteries, you could argue that Tesla is even being rewarded for bad behavior.

There are also the often overlooked environmental concerns of Teslas wearing through tires and brake pads at a faster rate due to the weight of the vehicle.

As infrastructure and production scaling improve, these concerns will all be addressed, but right now carbon credits act as free money for unrealized goals, and pats on the back for the world’s biggest polluters.

With that, what are your thoughts? Do you think the carbon credit market is a meaningful incentive system? Should Tesla receive additional rewards for making EVs? Is there a better system to promote emission reductions? Let us know at feedback@technologyprofits.com.