Posted September 29, 2022

By Ray Blanco

Does Cryptocurrency Provide the Path Forward?

It’s been a while since cryptocurrency was last seen as a haven for stocks as the major cryptos have seemingly moved in lock-step with the broader stock market.

And while stocks have struggled in 2022, so has the crypto market.

Still, a ways off previous highs, cryptos like bitcoin and ethereum have struggled to make up any lost ground or push higher in any meaningful way.

But with how gloomy the outlook is on the current stock market environment, and the global currency market, some are looking toward crypto to become a haven once more.

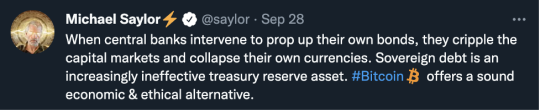

Michael Saylor, the co-founder of MicroStrategy, a company that provides business intelligence, mobile software, and cloud-based services, said bitcoin offers a non-sovereign store of value.

This comes while policymakers at the Bank of England scramble to stabilize financial markets with bond-buying.

It seems like central banks all over the world are having trouble with everything from currency strength, to bonds, and inflation.

Regardless of where you look, there’s weakness in almost every market imaginable right now.

So it’s not unbelievable that some are looking towards crypto as an escape… Let’s take a deeper look.

Escaping The Carnage With Crypto

In a series of tweets, Saylor continued on how central banks are hurting capital markets and currencies when they take steps to intervene. Bitcoin, on the other hand, cannot be manipulated by the government.

Digitizing money has been an ongoing development for some time now. Even though bitcoin and other coins have a ton of volatility tacked on, there are some benefits to a centralized, digital currency.

New technologies hope to democratize finance and broaden access to financial products and services.

The main goal is to reach a point where we have much cheaper, instantaneous domestic and international payments.

These benefits could be especially great for people in developing countries.

A big problem with this concept right now is the wild volatility found in most cryptocurrencies.

One thing you don’t want in a central currency is volatility…

For example, at bitcoins' all-time-high it was worth around $61,000. Today, it’s sitting right around $19,000. That’s nearly a 70% decline in almost a year!

But that’s just looking at bitcoin…

Of course, there are other cryptocurrencies out there whose purpose is remaining stable or mirroring a traditional currency.

But with so many different coins available, we get back to the problem of deciding which coin should be king crypto.

No doubt, support for crypto has grown exponentially in the past few years.

As the space continues to gain acceptance among financial institutions and banks around the world, we'll see more and more companies jumping in. It seems like it is happening every day.

So while bitcoin and the broader crypto market has struggled to get back on its feet this year, I don’t think it’s out for the count just yet.

Overall, I am excited to see where the trajectory of the broad crypto market ends up going.