Posted March 15, 2023

By Ray Blanco

Chips Away From China

When it comes to chip designs, the US remains a dominant player in the business.

From Apple processors to Nvidia GPUs, a huge share of the world’s chip design business originates in the US

And it’s a lucrative business…

Despite weakness on the manufacturing side, US companies accounted for around 46% of 2021’s $556 billion in sales.

But computer bits are of little use without computer chips, and if the physical side of the business comes under threat, the entire industry tumbles.

What happened in Silicon Valley in the 1960s changed the geopolitical landscape forever.

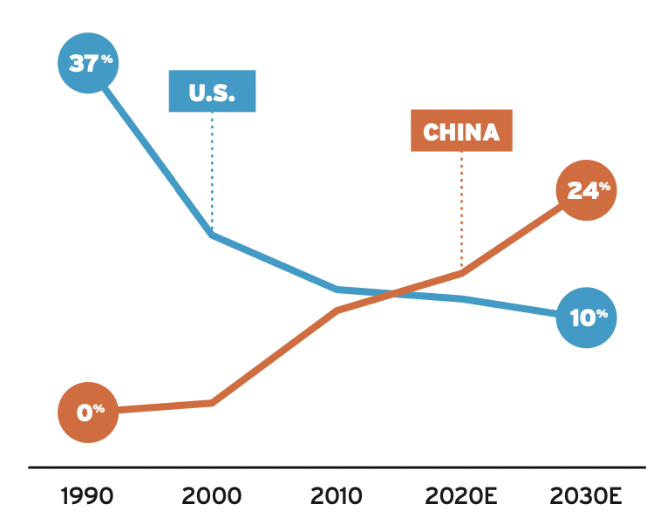

But the US’ position in semiconductors quickly started to erode after the end of the Cold War, with chipmaking jobs moving overseas where semiconductors could be made more cheaply.

In 1990, the US was responsible for close to 40% of global chip production.

By 2020, that figure had dropped to just over 10%, as foreign governments have invested heavily in developing their own industries, with China’s own share rising to surpass the United States’.

Fortunately, the US has woken up to the danger it's now facing in the face of potentially losing its supply of semiconductors. With the recently signed CHIPS and Science Act, the US is incentivizing the reshoring of lost semiconductor manufacturing capacity, securing domestic supply of critical technologies while creating high-paying jobs.

The US government hopes the $50 billion it has set aside in the new law will reduce reliance on vulnerable or overly concentrated production of both leading-edge and more mature chips.

And the US isn’t the only country ramping up semiconductor manufacturing…

South Korean Semiconductors

South Korea has long been a global leader in the semiconductor industry, with companies like Samsung and SK Hynix among the top producers of memory chips in the world.

And now, the South Korean government is taking steps to ensure that its dominance in the industry continues by allocating new funding to support semiconductor manufacturing.

South Korea recently announced plans to create the world’s largest semiconductor base in the country over the coming two decades.

And South Korea’s private sector is throwing some serious money into that goal…

From The Wall Street Journal:

A new industrial complex for advanced semiconductors will be formed by 2042 in the city of Yongin in Gyeonggi province near Seoul, based on private-sector investments of around 300 trillion won, equivalent to about $228 billion, South Korea’s Ministry of Trade, Industry and Energy said Wednesday.

That investment is coming from Samsung Electronics Co. which plans to build five plants in Yongin that will support a mix of Samsung’s contract chip-making operations and memory-chip production, a company spokeswoman said. The complex will also host as many as 150 materials, components, and chip-design firms, according to the ministry.

The Yongin complex, together with existing chip-making facilities run by Samsung and SK Hynix Inc. will form the world’s largest single-site semiconductor base, the ministry said.

This investment in its semiconductor industry is quite a strategic move that South Korea hopes will maintain its competitive advantage in the global market.

With China and Taiwan as two major players in the semiconductor manufacturing industry, South Korea, the US, and a list of other European countries are all looking to solidify their positions in the industry and shoulder some of the market share away from China.

Overall, the new funding governments and private entities around the world will likely have a significant impact on the semiconductor industry as a whole.

By supporting research and development and increasing production capacity, South Korea and other countries are positioning themselves to remain key players in the industry for years to come.

And with the global demand for semiconductors only expected to increase, the timing of these investments couldn't be better.

Now, before I go, I’d love to hear back from you about today’s topic. Do you enjoy hearing about the semiconductor industry? If so, is there anything you’ve heard about that you’d like me to cover? Drop me a line and let me know here: feedback@technologyprofits.com.