Posted October 06, 2021

By Jonas Elmerraji

Bitcoin vs. Facebook -- Plus, More on Brazil’s Bitcoin Bet

Facebook. Bitcoin.

The two are having very different weeks.

Facebook got swatted lower thanks to the one-two punch of a whistleblower coming forward about internal research showing harmful effects on users and then a major service outage that lasted much of Monday. Bitcoin’s surging thanks to a handful of catalysts – one of which is news that Brazil is considering making the king of the cryptos legal tender.

So Facebook and Bitcoin are getting lots of attention this week for opposite reasons.

And as of this writing, only one of them is worth $1 trillion in total market value…

Likewise, only one of them is projected to be worth $2 trillion or more in the next year by scores of analysts…

Yesterday, my colleague Ray Blanco told you about what’s happening in Brazil. A bill making the cryptocurrency legal tender has been approved to be presented to the Plenary of the Chamber of Deputies next week.

The country wants to regulate Bitcoin so that transactions are reliable and transparent. “We want to separate the wheat from the chaff, create regulations so that you can trade, know where you’re buying and know who you’re dealing with,” said Brazilian Federal Deputy Aureo Ribeiro in a story from Yahoo Finance.

If Brazil follows El Salvador’s lead in making Bitcoin legal tender, the consequences could be huge. El Salvador is a country with a population of 6.5 million people – Brazil’s population is more than 213 million. It’ll be interesting to see how the additional demand driven by adding utility to Bitcoin impacts the price.

Here at home, U.S. regulators have weighed in on the heels of China’s crypto crackdown, with SEC Chairman Gary Gensler telling Congress yesterday that he doesn’t plan on following China’s lead.

But I don’t think that or even the Brazil news is the biggest driver of this week’s rally.

Data I’ve seen recently suggest that Bitcoin is supply-constrained right now. The number of bitcoins available to trade on exchanges has been plummeting in 2021. That’s because folks are holding their coins long-term – and according to crypto analytics firm Glassnode, those folks were overwhelmingly in profitable positions heading into this week.

In my view, that’s a recipe for more big upside surprises like the one we saw this week.

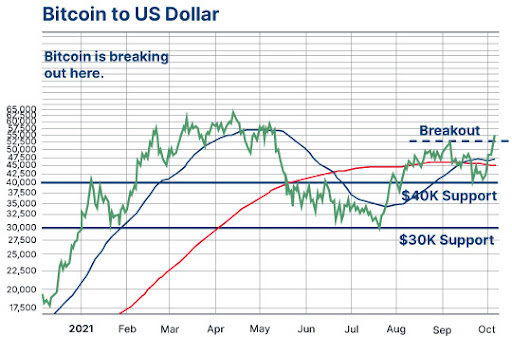

Looking at Bitcoin’s chart, the story we’ve been hammering since this spring continues to play out.

Bitcoin is breaking out this afternoon, pushing to new multimonth highs.

Right now, it’s back within grabbing distance of the all-time highs put in back in the spring. Of course, it’s unlikely to be a straight path to a retest of those highs. But I think it’s much more likely than not that we’ll see them tested in 2021.

From there, the next likely upside target is probably the big $100,000 round number. Stay tuned – things could get very interesting!

Sincerely,

Jonas Elmerraji, CMT