Posted September 20, 2022

By Ray Blanco

All Eyes on The Fed

Stocks slipped today after yesterday's small pop that kicked off the week.

These back-and-forth days ultimately don’t do much to change anyone’s mind about the market when the closing bell rings.

Instead, a looming Fed meeting is front and center in most traders’ minds.

We saw more indecisive action today that will likely continue tomorrow morning leading up to this week’s big event, an expected 75 bps rate increase.

Some have speculated that there’s a small chance of a larger rate hike, a full 100 bps, citing a higher-than-expected CPI report that rocked the markets last week.

The case for a full point hike is that the surprisingly hot inflation reports this year have made officials less confident in how the inflation process is operating.

The other side of that is the worry that the Fed started trying to tame inflation too late and raising rates too quickly would make a soft landing almost impossible.

There’s certainly a lot going on in the market that’s keeping people on edge.

We see it play out in low-volume, back-and-forth action with the occasional big move.

There’s a chance we could get some more clarity tomorrow, but it’ll likely just be more of the same…

For now, let’s take a look at how inflation has worked its way through consumer prices.

Inflation Across Different Sectors

As is expected, rising prices vary across different sectors. Some get hit harder than others, while some actually see prices fall.

This article here from The Wall Street Journal has a nice heatmap at the bottom that shows you how prices have changed across different sectors and industries from this same time last year.

There are a couple that stood out to me…

For starters, smartphone prices fell over 20%, giving smartphones the biggest negative price change.

Other price drops include things like televisions, down 19%, information tech commodities, down over 8%, and video/audio products, down about 9%.

The biggest price increase, which may come as no surprise, is fuel oil, which rose over 68%.

There are plenty more price increases than drops, putting overall consumer prices in August 2022 8.26% above the same time in 2021.

This is almost certain to translate to another 75 bps rate hike from the Fed tomorrow.

While some think the Fed is raising rates too slowly, which is why we haven’t seen inflation slow down yet, it’s important to remember that rate hikes take time to bake in.

On average, it takes about 9 months, or 2-3 quarters, for rate hikes to achieve the desired effect of reining in inflation.

There’s even a chance the Fed is raising rates too quickly and is on track toward deflation.

Whatever the case, investors are waiting impatiently to see if we’ll get some clarity out of tomorrow’s policy meeting.

Now, what does this mean for the market?

How Far Will We Fall?

Today, the S&P 500 is down a bit over 18% so far this year.

That’s still a little above the most recent bottom this year, which we saw in June when the S&P was down just over 23% YTD.

There are a couple of places you can look to when you’re trying to predict where stocks will go.

One that’s probably top of mind for today: bond yields.

The 10-year yield snuck over 3.5% this morning, marking its highest level since 2011.

Some analysts think we could be heading for 4% or higher, meaning more downside ahead for stocks.

Traders may get some bullish optimism if yields start to sink, but for now, the signs are pointing higher.

Another interesting place to look is history.

While historic market data doesn’t indicate what the future will bring, it can be good to see how investors have reacted in the past when similar events were unfolding.

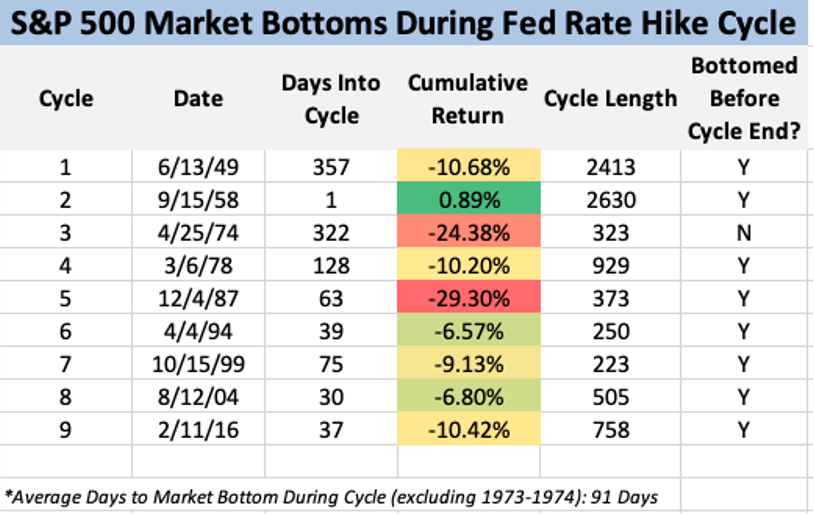

A friend and coworker shared this set of data with me today:

What we’re looking at here is price action in the S&P 500 during major Fed rate hikes.

Since 1945, the S&P 500 has bottomed during 8 of the last 9 major Fed hike cycles.

The lone exception: 1973-1974.

Average trading days to bottom from the first hike: 91.

To give some context, In March 2022, the Fed kicked off its rate hike cycle with its first hike of 25 bps.

That puts us 188 days into the rate hiking cycle.

The most recent market bottom we saw was on June 16th, 92 days into the Fed’s most recent rate hiking cycle.

That makes me think there’s a solid chance of a turnaround if investors see proof of slowing inflation.

For now, inflation is still a big problem, and until it starts to fall, the Fed is likely to remain aggressive in terms of raising its rates and reducing the money supply.

Generally speaking, this has a negative effect on the stock market.

As I mentioned above, all eyes will be on the Fed meeting tomorrow so we’ll see what we get…